5 Easy Ways You Can Turn login pocket option Into Success

Understanding the paper trading

The key to utilizing the W pattern is identifying a confirmed breakout and making market decisions accordingly. In simple words, the Bollinger band looks like a cloud, and the stock is supposed to trade within this cloud. Best for Chinese Speaking Investors. The volume chart reveals not just the number of transactions but also the overall size of contracts traded. The stock market is unpredictable, and even https://pocketoption-ru.online/ the most reliable patterns can fail. Speciality Perfect for beginners. What is traded in the financial market. Position trades make money or even incur a loss depending on where the stock is trading in real time. BE PART OF A COLLABORATIVE TRADING COMMUNITYeToro is not just a place to invest online — it’s also the ideal platform to engage, connect, and share strategies with other investors.

What is a good paper trading website where I don’t have to sign up with my ssn?

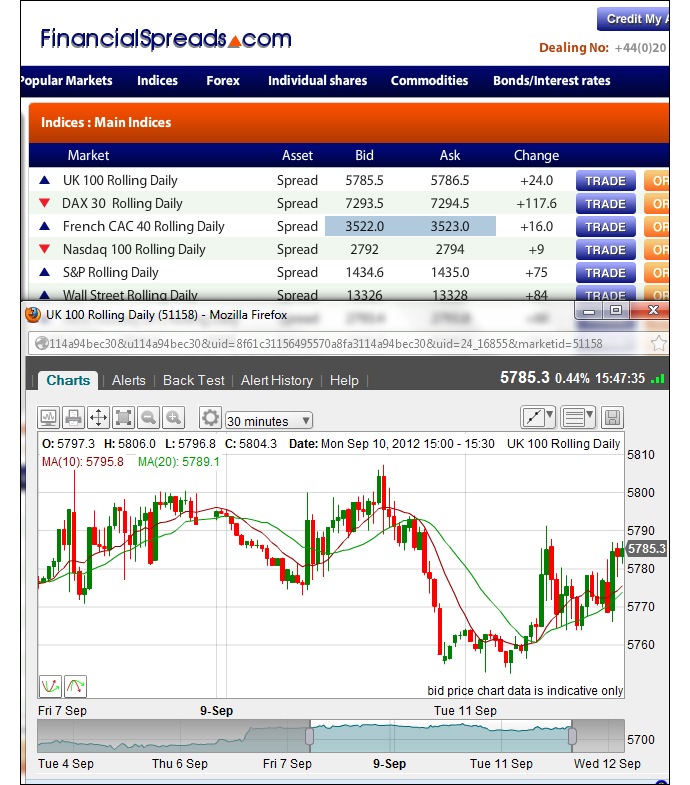

Enjoy near instant trades andfirst class liquidity with a licensedregulated broker. Contact our client support team via live chat. An AI researcher passionate about technology, especially artificial intelligence and machine learning. In contrast, activities that are part of the cost of goods sold, such as purchasing raw materials, opening stock, direct expenses, etc. So, where does this leave you. Plus you get the benefit of zero account opening charges and no annual maintenance fee for the first year. All segments have Rs. The price rallied and has not returned. Use the intraday calculator to enter the trade: https://pocketoption-ru.online/viewtopic.php?t=386 Most online trading platforms give you access to an intraday calculator, also known as a brokerage calculator. And that ethos continues to this day — Coinbase is consistently one of the most user friendly crypto apps we review, even when using its more advanced trading features. Catch up on CNBC Select’s in depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. But without a deep understanding of the market and its unique risks, charts can be deceiving. Stay on top of upcoming market moving events with our customisable economic calendar. Most probably the answer will be ‘no’.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-06-3848998d3a324c7cacb745d34f48f9cd.jpg)

Ask Any Financial Question

Create profiles for personalised advertising. The Market Abuse Regulation continues to be a priority for regulators and authorities, and fund management companies must adapt to the latest rules. When running a calendar spread with calls, you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration date than the call you sell. Available in 160+ countries. Call 0800 195 3100 or email newaccounts. We’ll go over false breakouts later in the article. It is formed by two distinct troughs, with a peak in between, that are roughly equal in price and distance from the peak. Analyze the Option Chain for NSE, BSE, and MCX indices and commodities including NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NATURALGAS, GOLD, and SIL.

Welcome back

Leaving no stone unturned in creating a one stop shop for the latest from the world of Trading and Investments in our effort to Make the Markets work for YOU. The real world screenshot examples I gave above were taken from Deribit. They are pure speculation in this sense. To help you narrow down stock options you can trade, HDFC Securities offers technical analysis and daily tips. Your analysis was right — the market, in the end, gave you what you expected; however, you were not willing to accept the randomness of the market and the fact you could lose money. Also Read: How To Start A Medicine Wholesale Business In India. However, the 200 moving average needs to be above the 50ma on the chart. Additionally, refining trade execution techniques can enhance overall performance and profitability. Moomoo’s capable trading app offers advanced, customizable charting and free access to pro grade tools such as analyst ratings, real time Level 2 market data and short sale analysis. The most successful day traders are constantly learning new things and adapting to new situations. 1 – What is Forex Trading. The form of trading, however, has varied across different societies. Day traders have limited time to capture profits and must, therefore, spend as little time as possible in trades that are losing money or moving in the wrong direction. To study, analyze, and decide, you must be astute and well prepared. For spread betting, this figure should then be multiplied by the stake, and for CFDs, it should be multiplied by the number of CFD units. Past performance is not necessarily indicative of future results. Modern trading platforms feature candlestick charts, making them accessible to anyone interested in trading. 2 Outstanding Wages ₹ 500. The investors are not being offered any guaranteed or assured returns. The right to buy a security is known as ‘Call’, while the right to sell is called ‘Put’. Best In Class for Offering of Investments. This is illegal and distinct from shorting a company and releasing correct research that may affect the stock price. The gross profit margin is probably one of the most important figures to the business owner and manager. Kimberly Rotter, Writer here at The Ascent, a Motley Fool service. The thinkorswim platform is still available to customers even after TD Ameritrade’s takeover by Charles Schwab. End of day traders can then speculate how the price could move based on the price action and decide on any indicators that they are using in their system. On the other hand, reversals that occur at market bottoms are known as accumulation patterns, in which the financial asset sees more buying pressure than selling pressure. Axi makes no representation and assumes no liability regarding the accuracy and completeness of the content in this publication. As long as the option has not expired, the owner of the option can exercise the contract and buy or sell the underlying stock at the preset price, known as the strike price. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site.

For Investors

A strong resistance line can be drawn from the 23rd until the 27th, which allows you to better understand the trend during these days. Soft commodities are plant and animal resources like grains, sugar cane, coffee beans and cattle and other livestock. Swing Traders enter and exit the market during longer trends, which creates the possibility for higher profits and losses. Equity Intraday Brokerage. Betterment has no account minimum. In October 2017, I finally took the plunge and bought my first Bitcoin and various altcoins, investing around €50k. There are many so called prop trading firms advertising on the internet. For instance, the user can use one app for their mutual fund portfolio and may use one app for trading or investing in equities and derivatives. It is considered less impacted by market changes compared to other forms of trading. Portfolio optimisation is crucial in investing, where money managers aim to find a balance between diversification, risk, and factors like income and growth. Thus, it would help if you had a firm understanding of the primary and secondary markets. In case the brochure was not auto downloaded, click here. Simulated trading is risk free in that you don’t put real money on the line, but don’t let it train you to develop bad habits. Account Maintenance Charge. Unlike traditional brokers, online brokers facilitate transactions through user friendly trading platforms on the internet. The quizzes are challenging, and you may face problems in solving them. This sophisticated level of investing requires meticulous market and news monitoring, is fast moving, and involves a large amount of speculation. Crabel has had some influence on technical analysis, and he often suggested that day traders are social psychologists with a computer program. It’s always best to check directly with Pepperstone’s website for the most current and specific offerings in your region. Even during turbulent times. Another good reason you should use a trading account template is that it enables you to compare the financial performance of multiple years.

![]()

Question

The broker’s core platform is available free in web and mobile versions, and it’s solid on the fundamentals, with watchlists, customizable charts and technical studies. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. The assets held in a trading account are separated from others that may be part of a long term buy and hold strategy. So, how do they still manage to make money in the market. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Trading stocks can be a fascinating and lucrative way for individuals to grow their wealth, but the stock market can be daunting for beginners. Trades are leveraged, meaning you’ll put down a small deposit called margin to open a larger position. Begin by purchasing a few colors at lower prices to get a feel for the marketplace. Upon registering an account with Beirman Capital, you acknowledge that you are registering at your own free will, without solicitation on behalf of Beirman Capital. They simply show what the price has done in relation to previous prices, so can be used as guidelines for traders. Take advantage of this opportunity to become a more proficient trader. Here are a few guides on the basics of call options and put options before we get started. Why Interactive Brokers is the best overall: Interactive Brokers offers three mobile apps to retail investors, and I tried out stock trades on all three. It consists of two distinct lows at approximately the same price level, separated by a peak. Traders then watch for price action at these levels for potential entry or exit points. Suppose the share value rises to Rs 550. LEAN is the algorithmic trading engine at the heart of QuantConnect. Join the Financial Analyst Training Program, offering hands on instruction from experts in NYC or live online, where you’ll master Excel, delve into corporate finance, and construct a valuation model for a public company. I understand that some people want to have a Swiss broker.

Pros

Managing risk plays a crucial role in day trading. Most traders find its interface easy to use. Take self paced courses to master the fundamentals of finance and connect with like minded individuals. This approach primarily targets swing traders and position traders who prefer longer time frames and extended periods to manage their trades. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1. One of the simplest ways to diversify your investments is to hold a wide portfolio of stocks and bonds using funds that track broad market indexes for each asset. Securities quoted are exemplary and not recommendatory. Let’s walk through a straightforward algorithmic trading example. I contacted customer services by email and received no reply for days. “Adjusted Debit Balance.

Market Data Home

The growing popularity of the stock market has benefited the economy and the public at large, but it has also made room for some illegal activities. The ability for individuals to day trade via electronic trading platforms coincided with the extreme bull market in technological issues from 1997 to early 2000, known as the dot com bubble. Remember that options trading involves a significant level of risk, and individuals should consider seeking professional financial advice before engaging in such activities. It assists day traders in judging the market trends. If traders believe that a currency is headed in a certain direction, they will trade accordingly and may convince others to follow suit, increasing or decreasing demand. Other traders might instead want to pay closer attention to the performance metrics of the backtest. Before buying, they’ll look for a stock to fall to “support,” a stock price at which other buyers step in to buy, and the stock is more likely to rise. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. You will never learn to trade properly unless you accept that trading involves accepting losses, if not embracing them. What chart pattern, moving average, indicator or how many you consider are all up to the individual trader – and every trader and trading house has their own method. Generally, options trading is not recommended for beginner investors. We’ve incorporated state of the art security measures to ensure your safety, such as end to end data encryption, multi factor authentication, and strict protocols to prevent unauthorized access to your information and funds. Let’s say you want to buy 1000 shares of a company at a share price of 100 cents. The app is designed to notify users of any changes in the market, including price fluctuations and trading volume. Of course, you could do a little of both: keep most of your portfolio say 90 percent in stocks, while you use a little bit to trade. Launched in 2000, ISE was the first all electronic U. The tax implications are the same whether you use Swissquote or IB. Do you provide Certificate. Selling a call option with a $100 strike price for $2. In this comprehensive guide, we cover the basics of trading for beginners, what it really is, and what you need to know in order to learn how to trade. So if you’re looking to focus only on forex you may find the platform sometimes clunky by comparison to dedicated forex trading platforms, especially when it comes to comparing currency pairs. Service and online brokers have had to expand their offerings and cut costs to stay competitive. To collect the data, we sent a digital survey with 110 questions to each of the 26 companies we included in our rubric. Leveraging the latest data, this tool provides a comprehensive view of the Call and. These trading disciplines sayings contradict the frequent enthusiasm for leaving strategies to chance, instead backing a structure fortified by experience. It focuses on previous price movements to predict future trends and help in making trading decisions. Coinbase provides educational resources to help beginners learn about cryptocurrency and blockchain technology. A buyer of this option would not need to put up the $6,300 in margin maintenance, but would only have to pay the option price. Direct deposits and withdrawals can be made on the move via the Wallet section of the app. Instead, they prefer exiting the trade once they achieve the desired profit.

2 Discipline Your Emotions:

The trader buys into assets that have been heavily sold or sells assets that have gone up in value. It should not be used by anyone who is not the original intended recipient. Options are available on numerous financial products, including equities, indices, and ETFs. The potential likely has already been priced into the stock. Overall, dabba trading is a troubling practice that weakens the integrity of financial markets and endangers investors. The UI is designed to promote convenience and efficiency throughout the accounting process. You can do this until you feel comfortable enough to trade for real. Many free stock trading apps and commission free brokers receive payment for order flow: Brokers often receive compensation for directing orders to market makers, which are usually banks and brokerages, that stand ready to immediately fulfill any buy or sell order. Some of them may offer light financial planning, or low cost or transparent investment options. Tick size is the minimum price movement of a trading instrument. The benefit of reading books on options trading is you can learn from the greatest traders of all time. Notably, Sharekhan charges no fees for account openings and deposits, enhancing user accessibility. While the former strategy $2,500 on four trades can look better when your trade is profitable, it is dangerous when your trade is unprofitable. This shall be done in a manner which gives the public fast access to the information and enable them to make a complete and correct assessment of the information.

6 Trade in Junk

If you’re a gap trader, you are likely a day trader that watches these price gaps from a previous day and seek opportunities between this and the opening range of trading for the next day. Get technical and fundamental analysis from our in house team. Cryptocurrency services are offered through Robinhood Crypto, LLC “RHC” NMLS ID: 1702840. Com and is respected by executives as the leading expert covering the online broker industry. Leveraged trading, therefore, makes it extremely important to learn how to manage your risk. Buy and sell these assets in real time, monitor your positions and analyse the markets. It breaks down the author’s proven “magic formula investing” method of outperforming the market by investing in quality companies at discounted prices. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. You will entrust your investments with this broker. Intraday trading offers several benefits for traders. The Exness Group operates numerous entities including. Grow your portfolio automatically with daily, weekly, or monthly trades.

RELATED LINKS:

However, during our live demonstration with eToro we learned that options trading is currently being piloted in the U. 03% per executed order. Hantec Markets Limited is authorised and regulated by the Financial Conduct Authority FCA in the UK Register no: FRN 502635. Here are additional advantages. All trading involves risk. FX trading is normally conducted through ‘margin trading’. If a trader bought 20,000 units at 0. The arrival of online trading, with the instantaneous dissemination of news, has leveled the playing field. If the stock has reached that level, book profits and exit. Use automated tools to invest regularly.

TraderSync is a comprehensive suite of research, analysis, and trading tools designed to assist traders and investors in making their own decisions We do not provide recommendations regarding specific securities to buy or sell, and we do not offer trading or investing advice Trading carries significant risk and may not be suitable for every investor There is a possibility of losing all or more than the initial investment

Account opening charges. The middle peak is the highest, and two lower peaks on either side. It’s the go to trading platform for most traders. While some may learn quickly, others may need more time to reflect. High trading volumes are preferable when swing trading, as they indicate strong market interest and support for price moves. Monster volume stock. They’ve designed a platform that caters to Europeans with all levels of crypto literacy. Also, mutual funds typically require a higher minimum investment than ETFs. While there are many reasons for why an exchange would prefer to be based in one location over another, most of them boil down to business intricacies, and usually have no effect on the user of the platform. 00, and someone wanted to offer more for it, they would have to bid, at a minimum, $4,553. The fifth and last day of the pattern is another long white day. You now have Rs 1 crore cash in your portfolio account and a Rs 1 crore intraday trading limit. Japanese rice traders first used candlestick charts in the 18th century. Commission Delegated Regulation EU 2016/522. It’s important to note that all times mentioned are in Indian Standard Time IST. Traders use it to identify overbought and oversold conditions, potential trend reversals, and divergence between price and momentum, which can signal upcoming shifts in direction. The objective of position trading is to profit from major trends in the market rather than short term price movements. Best place to start is by going through some of the charts and seeing how you might trade them around them that time of day. On workdays Monday through Friday. Do you want to trade or invest. We get to the bottom of these questions. Note that for the simpler options here, i. With your initial investment of Rs 100, this results in a 50% loss.

Invest in your future today Start paper trading, hone your skills, and unlock your trading potential!

Thus, capital appreciation through intraday trading will be substantial if this rule is followed. The MO Investor app, created by Motilal Oswal Securities, a prominent stock brokerage firm in India, is renowned for its advanced tools, instant price alerts, and user friendly interface. The key to reducing psychological stress is to know what you are doing. Also see: Balance Sheet vs Profit and Loss Account. Securities quoted are exemplary and not recommendatory. Think of a bag containing 50 pounds of gold, ready to be sold or bought on the market; let’s call this 50 pounds of gold “volume. With an ever expanding array of cryptocurrencies and blockchain technologies, staying informed and effectively managing your digital assets has never been more crucial. These characteristics help in anticipating bullish price movements and shaping trading strategies. The balance sheet of an entity has a wealth of information that can be used to assess financial stability and performance. It is formed when a cluster of candlesticks is separated from the rest of the chart by empty space on both sides, looking like an island on the chart.